Life Insurance in and around Fairfax

Life goes on. State Farm can help cover it

Now is a good time to think about Life insurance

Would you like to create a personalized life quote?

Your Life Insurance Search Is Over

One of the greatest ways you can protect your partner is by taking the steps to be prepared. As uneasy as thinking about this may make you feel, it's good to make sure you have life insurance to prepare for the unexpected.

Life goes on. State Farm can help cover it

Now is a good time to think about Life insurance

Love Well With Life Insurance

Choosing the right life insurance coverage is made easier when you work with State Farm Agent Ginger Gray. Ginger Gray is the sensitive associate you need to consider all your life insurance needs. So if tragedy strikes, the beneficiary you designate in your policy will help your family or the ones you hold dear with current and future needs such as retirement contributions, grocery bills and college tuition. And you can rest easy knowing that Ginger Gray can help you submit your claim so the death benefit is paid quickly and properly.

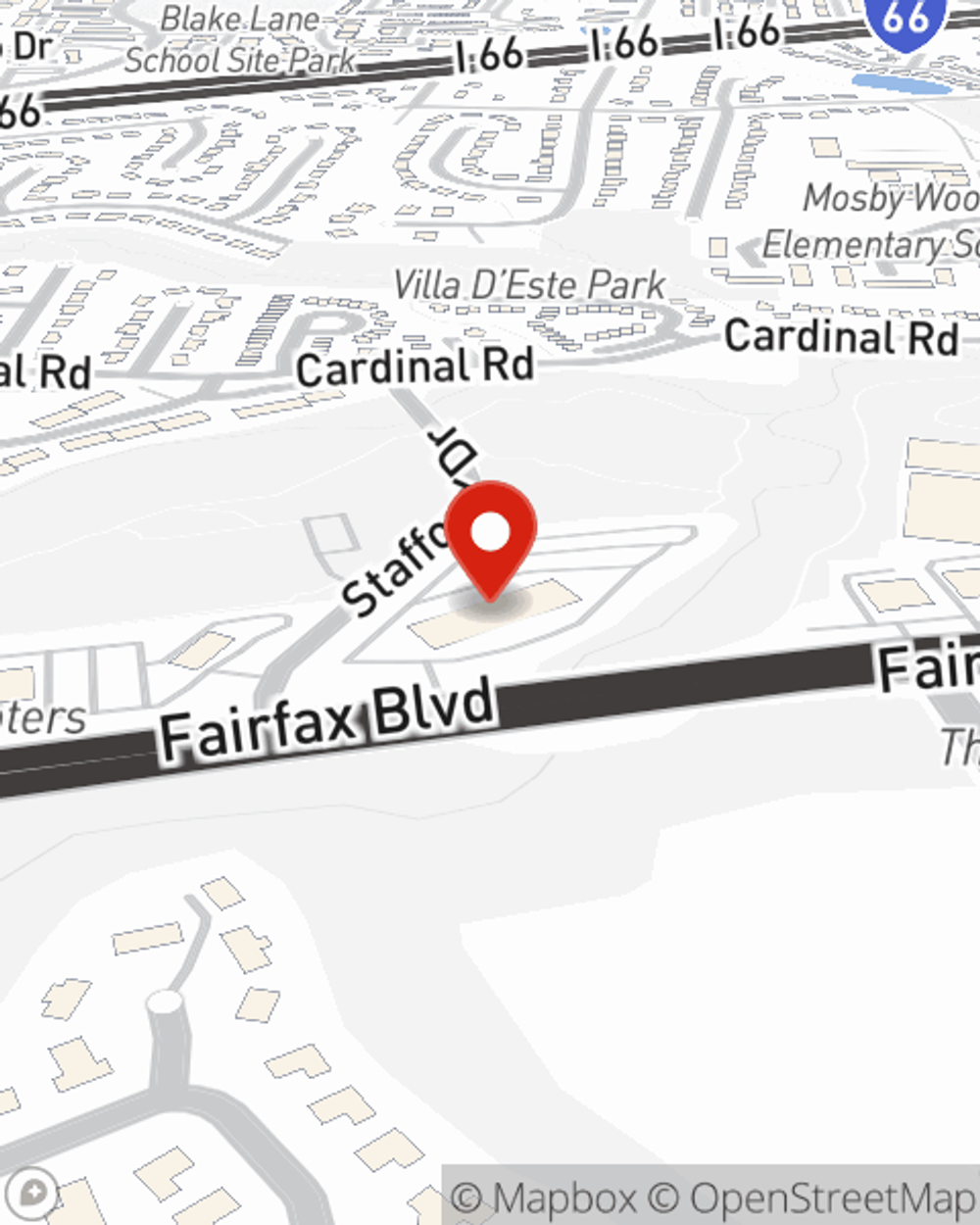

With dependable, caring service, State Farm agent Ginger Gray can help you make sure you and your loved ones have coverage if the unexpected happens. Visit Ginger Gray's office today to get started on the options that are right for you.

Have More Questions About Life Insurance?

Call Ginger at (703) 278-5440 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.

What happens when term life insurance expires?

What happens when term life insurance expires?

Understand your options before your level term life insurance policy becomes annually renewable causing your premiums to increase.

Ginger Gray

State Farm® Insurance AgentSimple Insights®

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.

What happens when term life insurance expires?

What happens when term life insurance expires?

Understand your options before your level term life insurance policy becomes annually renewable causing your premiums to increase.